As with most things in life, the condition of today’s real estate market in Marin is a matter of perspective. There are as many indicators on one side that point to better times as there are those pointing to the next leg down in real estate prices. The question is, what signals do we focus on to validate our opinions about whether to sell or buy in the current environment?

The recent emergence of wealthy buyers paying with cash has resulted in a number of $5 million to $10 million Marin properties closing in the first quarter. Encouraging, yes—but while the market for high-end properties appears to have strengthened, many agents say the market for middle and low-end single-family homes remains anemic. Condo sales in southern Marin are still weak, but sales in Petaluma and Santa Rosa are on the rise.

In southern Marin, agents say open houses are packed with tire kickers, but actual buyers are few and far between. In fact, according to BAREIS MLS, sales of homes in Marin during the first quarter declined 13.2 percent year over the year and 28 percent from the fourth quarter of 2008. Sales activity is the strongest in Novato and San Rafael, with 38 percent and 28 percent respectively of all homes for sale in contract. This is largely due to a greater percentage of short and distressed sales in those areas. And although prices are still declining, national real estate database Dataquick reports that the rate of decline is slowing, indicating the market may be near its bottom.

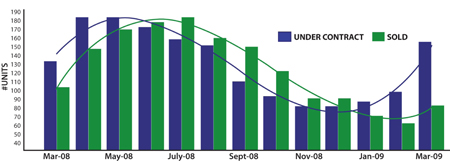

The reliable indicator of changing market conditions is new escrow activity. The chart illustrates activity over the past 13 months. New escrow activity bottomed out in December 2008 and began a modest ascent through January and February 2009. This increase in new escrows in March 2009 is a combination of demand returning to the market and the cyclical nature of the business. April and May closings should rise accordingly.

To keep things in perspective, last year’s March sales figures for the entire Bay Area were the slowest on Dataquick’s statistics going back to 1988. This past March was the third slowest, ahead of last year and March 1995.“More than any other region, the Bay Area is waiting for so-called jumbo loans to come back on line,” says John Walsh, MDA DataQuick president. “Even with prices off their peaks, most home purchases in the upper half of the market still require a mortgage for more than $729,450 (current conforming loan limit), which are far more difficult to come by. We think there’s a good chance those larger loans will become more available during the second or third quarter. For now, the extent to which prices have fallen in the upscale markets is more difficult to gauge because many of those areas are essentially in hibernation, with scant sales.”

Some sellers have resorted to creativity to spark the sale. Bill Smith of Frank Howard Allen in Tiburon has one client who is selling a $3.4 million Tiburon property. The seller is a collector of exotic sports cars and has thrown in his $200,000 Ferrari F430 Spider as an incentive for a full-price offer. It’s a unique idea and I suppose houses in Paradise Cay will soon be sold with yachts listed under the amenities.

As a seller, pricing for “perceived value” has proven to be a very successful approach. Homes sold in the first 60 days on the market generally close at or above 95 percent of the original list price. Homes sold after 120 days generally bring less than 80 percent of the original list price. One additional important fact: Marin County single-family homes costing more than $500,000 experienced only 173 closings in the first quarter, less than 20 percent of the available listings. Mark McLaughlin of Morgan Lane Real Estate said that trend indicates that it is still a buyer’s market. In turn, average sale prices are still approximately 10 percent below listing prices. However, with buyers and sellers aware of this, listings are inherently mispriced to compensate and offers are made with this spread priced in.

As a seller, pricing for “perceived value” has proven to be a very successful approach. Homes sold in the first 60 days on the market generally close at or above 95 percent of the original list price. Homes sold after 120 days generally bring less than 80 percent of the original list price. One additional important fact: Marin County single-family homes costing more than $500,000 experienced only 173 closings in the first quarter, less than 20 percent of the available listings. Mark McLaughlin of Morgan Lane Real Estate said that trend indicates that it is still a buyer’s market. In turn, average sale prices are still approximately 10 percent below listing prices. However, with buyers and sellers aware of this, listings are inherently mispriced to compensate and offers are made with this spread priced in.

“We are frequently asked, where is the bottom?” says McLaughlin. While some Marin communities have already seen the bottom, others still have some room to fall. Unless the stock market loses its footing again, McLaughlin views current trends as positive. As demand returns, prices should stabilize and begin to climb. McLaughlin believes the bottom has formed. If that’s the case, the worst could be over for those wanting to sell and buyers need to ask themselves if they want to be partially right or miss the current market opportunity.